Getting ready for college involves many steps and milestones! Apart from focusing on academics, however, you’ll also need to go through some practical considerations. Financial matters top the list.

According to the Education Data Initiative, the average cost of college education in the US is $38,270 per year. Needless to say, the amount is significant, and many families can’t handle such expenses without some help from the financial aid office.

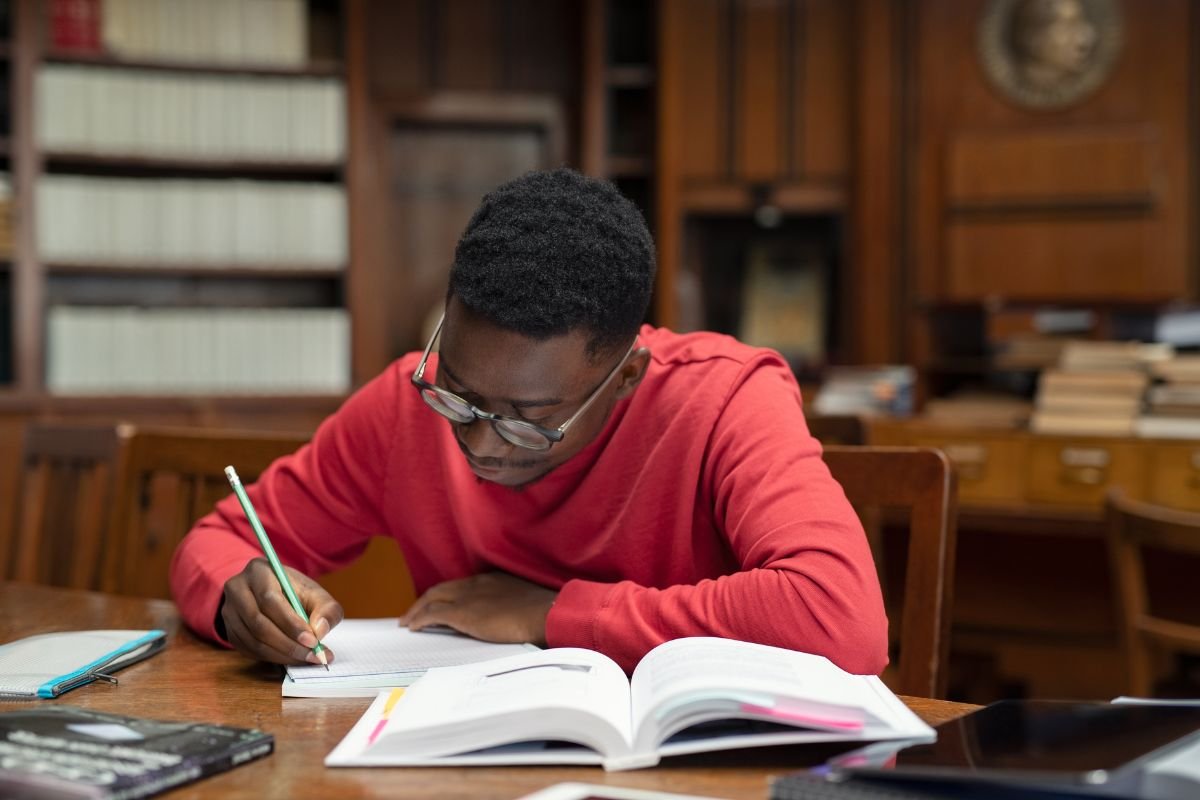

Financial aid options exist for both undergraduate and graduate students. If you’re thinking about how to pay for school, the following guide will outline essentials like:

Types of Financial Aid: Federal Student Loans and Grants for College

To handle the significant cost of college attendance, you may want to consider federal financial assistance. Federal aid comes in various forms:

- Federal loans: These can be direct subsidized loans or unsubsidized loans (like the direct plus loan). The first type is available for undergraduate students to help pay for college expenses. The loan limit for the first year of a college education is $5,500. Unsubsidized loans can be obtained by both undergraduate and graduate students, and the amount is determined by the school being attended.

- Federal grants: Grants are financial assistance packages that don’t have to be paid back. There are numerous types of federal grants, such as the Federal Supplemental Education Opportunity Grants, Pell Grants, Teacher Education Assistance for College and Higher Education Grants, and others. You can find out more about these financial assistance options and the eligibility requirements at the official Federal Student Aid Office of the US Department of Education website.

- Federal work-study programs: In this case, the amount will have to be earned, and arrangements are made between the student and the college. It’s important to understand the fact that work-study funds aren’t applied directly to cover tuition or other college-related expenses.

To apply, you’ll first need to fill out the Free Application for Federal Student Aid (FAFSA). Based on the information provided in the FAFSA form, you’ll get a response about your eligibility, the amount you’ll be entitled to, and the repayment schedule (in the event of qualifying for a federal student loan).

Speak with a college coach today!

Speak with an expert college coach and learn if working with one is right for your academic journey. Free 15-minute consultation, no cost, no obligations.

More Ways to Pay for College: State Financial Assistance

Apart from federal student loans and grants, college students can pursue assistance from the state, which also provides different types of financial aid. Some of the prominent state financial aid options include:

- Grants: Obviously, grant availability varies from one state to another. Contacting the local Department of Education office will give you more clarity on the types of grants available, eligibility for grants, and how they compare to federal grants.

- Scholarships: Most scholarship options are merit-based, and they reward exceptional academic performance by reducing the cost of college education. To apply, you will have to meet certain conditions, and you’ll probably also be asked to write a scholarship essay that grabs attention. Since scholarships are highly demanded, you’ll need to be strategic to stand out when pursuing this form of financial aid.

- State loans: Student state loans can be used to cover various educational expenses such as tuition fees, textbooks, and living expenses. Student state loans are typically issued at a lower interest rate compared to private loans and often have more flexible repayment terms to make it easier for students to repay the loan after graduation.

- Work-study programs: Work-study programs are a type of financial aid offered by many educational institutions and the government, which allows students to work part-time while attending school to help cover their educational expenses and improve their financial circumstances. These programs typically provide students with part-time jobs either on or off-campus, and the wages earned can be used to pay for tuition fees, textbooks, and other living expenses.

What can student loans be used for?

Student loans can be used to cover education-related expenses such as tuition, fees, books, and supplies, as well as living costs like housing, food, and transportation while attending college.

College Financial Aid Packages

In order to attract top talent and help you pay for quality education, many colleges have developed their own financial aid programs. The application process and qualification requirements vary. Most often, the financial assistance packages and the application requirements are listed on the official college website.

Colleges and universities can offer several kinds of academic merit programs and need-based financial aid. Some of these opportunities include:

- Different forms of grants

- Merit-based aid (also known as an academic scholarship)

- Need-based aid

- Work-study programs

Please take some time to find out if the college you’re interested in takes into account academic accomplishments, financial needs, or both when awarding financial aid to help pay for your education costs. You should also be mindful of the competition. The most popular colleges have thousands of students applying for financial assistance. As a result, you’ll find it a bit challenging to qualify for and secure your tuition aid.

What are the 4 types of financial aid?

The four main types of financial aid are scholarships, grants, work-study programs, and student loans.

Additional Types of Help and Scholarships for College

While the sources of funding mentioned above are the most prominent ones, alternatives do exist, and you may be eligible for financial assistance if you meet certain requirements. These alternatives often provide financial assistance for low-income families as well as for gifted college students who are struggling with their college expenses.

The financial aid eligibility requirements vary depending on the institution behind the respective program and its intent.

- Private student loans: Various financial institutions offer direct loan programs to help students get money for college. College students can request from a few hundred dollars up to a significant sum. Both banks and credit unions have student loans available. If you’re looking for private sources to cover your education expenses, do compare the terms and conditions carefully. Interest rates, repayment periods, flexible repayment options, and the need to have a cosigner are all important criteria to check out.

- Employer funding: If you are an employed individual, you may qualify for financial assistance through the company that you work for. Corporate student aid is in the interest of an employer – it gives the company access to highly qualified professionals. Getting such financial assistance, however, usually comes with strings attached. You may be obliged to remain within the enterprise for a certain amount of time after getting your financial aid and obtaining the college degree.

- Specialized aid: Military service professionals may be entitled to financial assistance. Military families could also benefit from funding options. There’s also specialized financial aid for international students, as well as packages that are designed for individuals pursuing particular fields of study. Check with your school of interest for more information on specialized options to help you pay for education.

Which financial aid options don’t have to be repaid?

Grants and scholarships don’t require repayment, as they’re awarded based on financial need, merit, or other qualifications.

How to Choose the Best Types of Aid Programs and Ace the Application Process

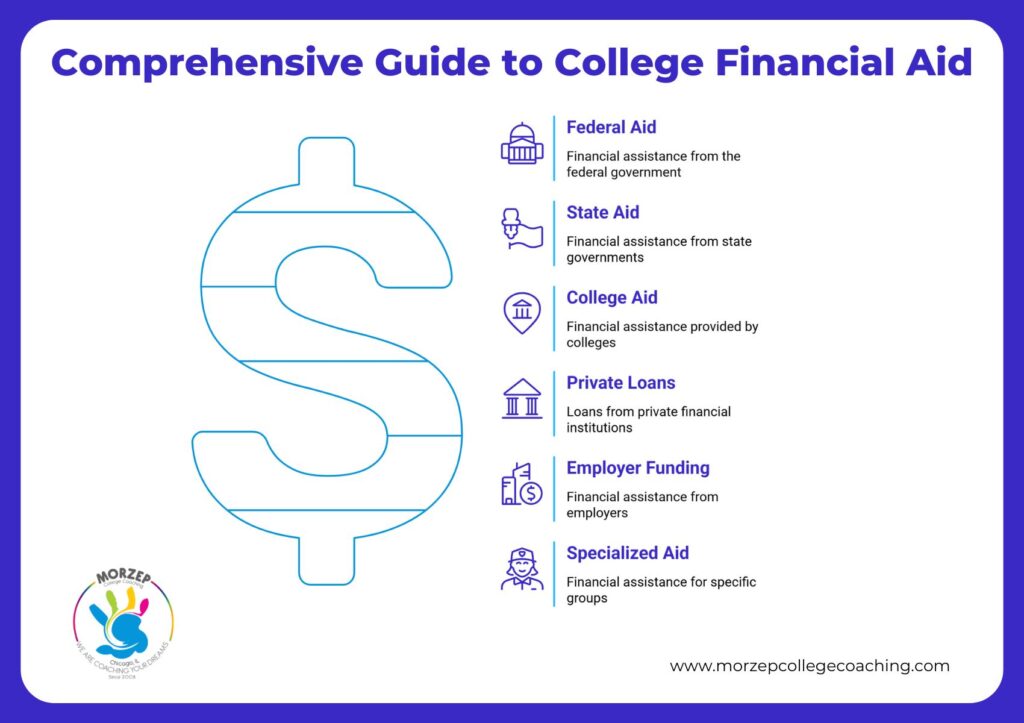

The financial aid process can be cumbersome and complicated, which is why you need a systematic and strategic application approach.

It’s a good idea to dedicate the summer between your junior and senior high school years to doing scholarship and financial aid research. You can easily get lost in all the opportunities and the various qualification requirements for each type of tuition assistance. Keeping track of application deadlines is also going to be a mission impossible unless you start early enough.

Start out by checking federal, state, and school financial assistance options. Usually, they provide better conditions than what you’ll get from private organizations such as banks. If you’ve been an impeccable student and you have above-average exam results, or you can prove remarkable artistic or athletic talent, you could also look into merit-based financial aid.

If you’re applying to multiple schools and also seeking financial aid, make sure your submissions are personalized. While there are similarities between the ways colleges award financial assistance packages, there could also be some particularities. A copy-paste approach is never a good idea, especially if your college education is heavily dependent on securing the respective aid.

Does financial aid cover housing?

Yes, financial aid can cover housing costs, including on-campus dorms or off-campus rent, as part of your total cost of attendance.

Financial aid can be a labyrinthine process. If you’re looking to simplify the process and speed things up so you’ll have more time to focus on your academic performance, you can always work with Morzep college coaches. They can provide assistance with your financial aid applications and recommend the best options for you.

Our experienced college coaches can guide you through the intricacies of college and financial aid applications. We will recommend the best funding options and help you fill out documents to increase your chances of a successful application. Once you get that financial aid award letter, you’ll know that all the effort has been worth it!

Ready to start your path to college and future success?

Do you want to know about financial aid and making the most of the college application process? Fill out our contact form today to get personalized guidance, answers to your questions, and a clear next step toward your goals!