Did you know that the average monthly cost of food alone is 672 dollars per college student? The total estimated living expenses college students have to cover are about 14,435 dollars per year. This amount includes food, housing, clothes, subscriptions, and other expenses. If you add an emergency fund and unexpected expenses to the mix, the numbers get even more troublesome.

So, is there anything you can do to handle expenses in an effective manner and even save some cash while in college? The answer is yes, you can start budgeting to be more aware of your financial habits and errors.

- Why managing student finances effectively is so important

- The spending habits and mistakes that cost you the most

- The best budgeting strategies that will help you stay on top of the money game

- The most useful tools, apps, and resources you can count on

Speak with a college coach today!

Speak with an expert college coach and learn if working with one is right for your academic journey. Free 15-minute consultation, no cost, no obligations.

Why Budgeting Strategies for Students Are So Important

Until now, you’ve probably counted on your parents to handle finances at home and manage your money. As a result, you probably have a very unrealistic idea about the amount required to cover essential expenses.

Budgeting as a student is important for numerous reasons:

- You’ll find out how much you’re actually spending per month and which living costs add up to the biggest sum

- You’ll get to cut unnecessary expenditures that are putting you in a precarious situation

- Students who budget find it much easier to meet their financial goals

- Many students actually find it easy to start saving and even investing in their future by adopting financially responsible practices

What is the 50 30 20 rule for college?

The 50/30/20 rule is a simple budgeting guideline that suggests college students spend about 50% of their income on needs, 30% on wants, and save or put 20% toward financial goals.

Common Money Management Mistakes to Avoid in College

Students face various challenges that can lead to financial struggles and even the accumulation of debt:

- Dealing with overwhelming student debt (the average student borrower has 39,547 dollars in debt, as per 2026 statistics)

- Lacking financial literacy, hence making irresponsible choices

- Not thinking about saving or even investing to make extra money at such an early age

- Being impulsive with purchases or borrowing to cover superfluous expenses

- Having no idea about all education-related expenses (like textbooks, additional supplies, and additional costs of attendance)

- Being overly reliant on a credit card

Surveys suggest that about 74 percent of college students are facing financial challenges. So, you’re not alone, but there are numerous things you can do to get out of this not-ideal situation.

The Best Budgeting Tips for Students in College

Having a good spending plan, knowing how to manage student loan debt, knowing how to thoroughly check a bank statement, cutting down recreational spending, and being realistic about your current money situation are all important budgeting steps that will help you out in the long run.

Let’s dig deeper and examine the best financial advice for college students.

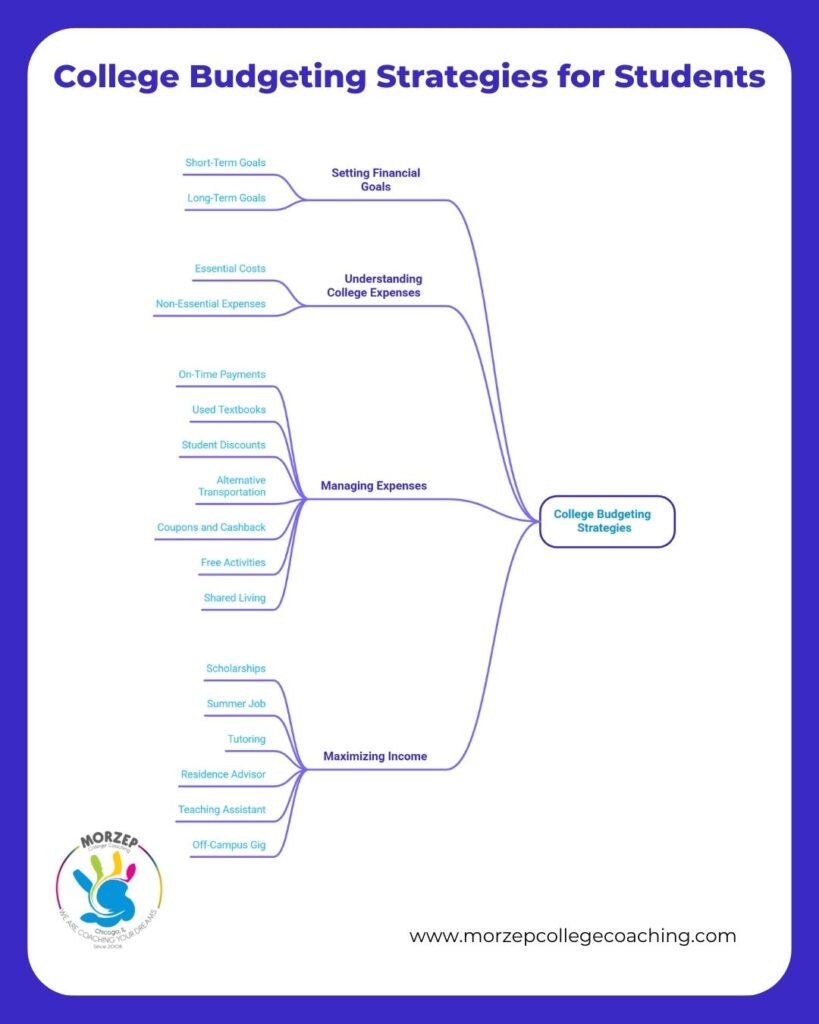

Setting Financial Goals and Having a College Budget

Start out by setting realistic financial goals as far as budget planning is concerned. This is the most important step to budgeting like an adult and making sense of all the financial information.

What would you like to accomplish in the short run? How about the long run? Pay off your student loans fast? Generate some extra savings? Start paying your bills on time? All of these goals are important, even if they seem like baby steps.

Is $500 a month enough for a college student?

$500 a month can be enough for a college student if major expenses like tuition, housing, or a meal plan are already covered, but it may be tight for those paying for rent, food, and transportation.

Having a Good Grasp of College Expenses

The first step towards coming up with a budget is tracking your current expenses over the course of one month. Grab a notebook and record every single dollar you spend. Chances are that you’ll be shocked by the amount dedicated to non-essentials.

In order to come up with a manageable budget, you’ll need to track your spending and financial situation in the following ways:

- Separate your essential costs (loan installments, a meal plan, textbooks, commuting, tuition fees, dorm expenses) from the non-essential expenses (entertainment, gym membership, social activities).

- Make sure you have enough money to cover the essentials first.

- Student budgeting should then focus on what to do with the remainder of your money (if there’s any). Will you be spending on non-essentials, will you be saving, or investing?

- If you don’t have enough to cover essentials and have a bit of extra in your monthly budget, you’ll either have to start thinking about cutting expenses or finding an extra income source.

Student Budget Tips to Better Manage Expenses

If you come to the conclusion that you have to lower your expenses, you can employ the following strategies to achieve good results:

- Make all your monthly payments on time to avoid late fees

- Consider buying used textbooks, as course materials can add up to one of the biggest college expenses

- Various businesses offer student discounts that you should be making use of

- Consider alternative transportation methods (ditch your car and opt for public transport instead)

- Try coupons and cashback (various apps can be used for this purpose)

- Opt for free activities and entertainment options (there are lots of cool and free things available on campus, including a college gym)

- Choose shared living space options so that you share housing costs

How can college students save money on textbooks?

Buy used, rent when you can, go digital, and check the library or classmates first. Little swaps can mean big savings.

Financial Tips for Students Looking to Maximize Their Income

Saving money in college is possible if you’re organized and dedicated to the process. Even if you’re studying full-time, there are ways to enjoy financial stability without being solely dependent on a parental contribution:

- Make sure you have excellent grades and apply for merit-based scholarships

- Look for additional scholarship, grants, or financial aid opportunities

- Consider a summer job or a work-study program

- Tutor other students

- Become a residence advisor (RA)

- Look for opportunities to become a teaching assistant

- Find an off-campus gig (in a café or a restaurant, consider freelance writing, delivering food, babysitting, etc.)

How much should college students save for emergencies?

Most experts suggest college students aim to save enough to cover one to three months of basic expenses. Even a small cushion can turn an “uh-oh” moment into a manageable one.

Best Student Budget Apps to Try Today

You can count on various apps and tools to create a budget in college and track progress on both short-term budgeting goals and long-term financial stability. Some of the apps that can help you manage money better include:

- Goodbudget: a great app for students making their first steps in the world of budgeting. It helps you keep track of expenses, pay off debt in time, and identify important monthly trends.

- Mint: a complex tool that allows you to connect your credit cards, bank accounts, investment accounts, and any other financial instruments to help you stay on top of both spending and saving.

- Ibotta: an excellent cashback app.

- Mint: a great tool to help you centralize your student budget.

From College Prep to Financial Confidence

The transition from at-home living to being a college student is a major one. You may end up needing some assistance to make sense of all the new things in your life. Our college coaching professionals will be there to guide you every step of the way, from applying to college to selecting the best ways to finance your education.

Morzep is focused on getting you ready for college, as well as understanding every possibility and challenge that will result from a great academic opportunity. Acquiring financial literacy is one of the essentials that the Morzep coaches will focus on.